Remitly review: how does it work, fees, transfer times & more

Remitly is an international payment company offering cross border payment services to a range of countries across the globe. It’s helpful to know that although Remitly serve some 45 countries, transfers can’t be made on some major payment routes, such as transfers to the UK, Australia, France or Germany.¹

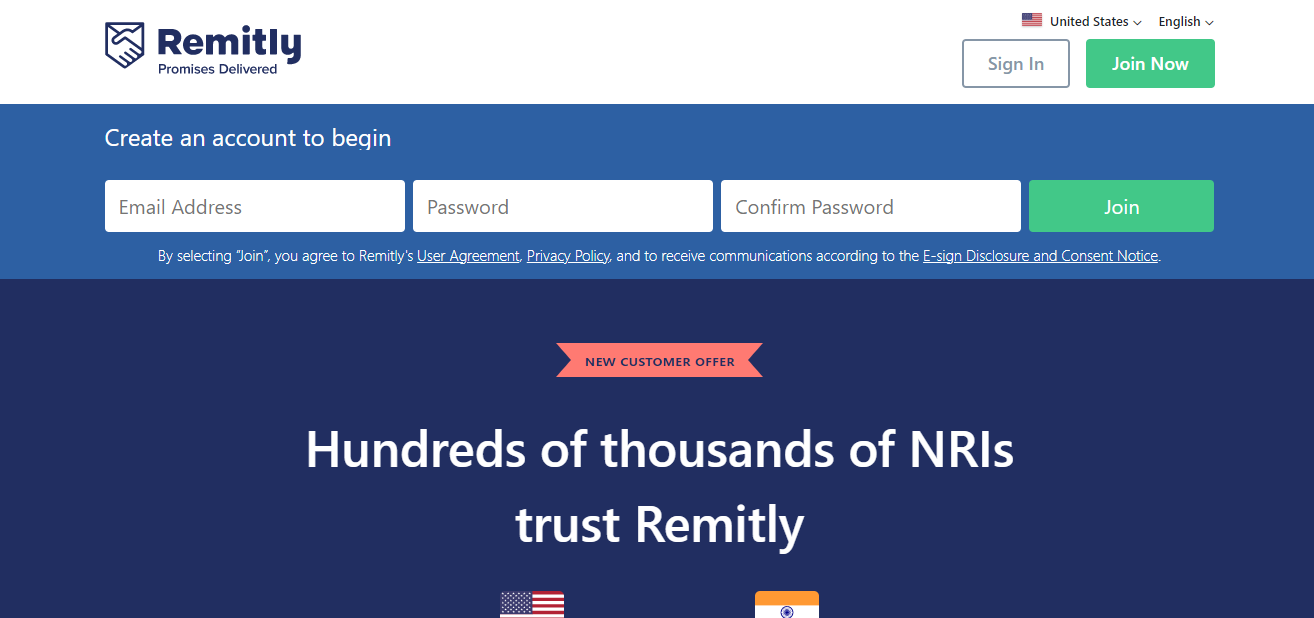

Signing up is free, and some customers may be eligible for promotional offers when they first start using the service.

When you’re deciding which company to use for your international payment, it’s a smart idea to do some research. There are many different services out there, which all offer different payment products, including varied fees and delivery times. Compare Remitly with some other providers to make sure it’s best for you.

This Remitly review will tell you all you need to know – and we’ll also highlight an alternative to kick start your search for the best deal – Wise.

How does an international transfer with Remitly work?

Remitly lets customers send money online via their website or app, to a range of countries around the world. You’ll need to first create a free account to get started, and can then a Remitly transfer. You simply enter the details of the person you wish to pay, select a payment method and transfer funds. Depending on where you’re sending money to, you may have the option to send using the Express service, which is funded using a credit or debit card, or the Economy route, which is funded with a bank transfer.²

The fees and delivery times vary for each service, with Express transfers typically costing more, but arriving faster than the Economy option. Fee structures also vary widely by destination country. You can model the payment you wish to make before you commit to the transfer, and you’ll also be able to check out our overview of the fees you need to think about, below.²

? Once you’ve modeled the payment you wish to make with Remitly, it’s worth comparing the fees and exchange rates offered with other online services such as Wise. Because Wise provide specialist transfer services which use the mid-market exchange rate with no markup – you just pay a transparent upfront fee – cross border payments can work out to be much cheaper than your regular bank.

You may also save even more time and money with a Wise multi-currency account. This account is perfect for people who travel a lot, need to remit money frequently, or get paid in foreign currencies. You can hold money in dozens of different currencies in the same place, and switch between them simply whenever you need to, making low cost international payments convenient and straightforward.

What are the fees when you want to transfer money overseas with Remitly?

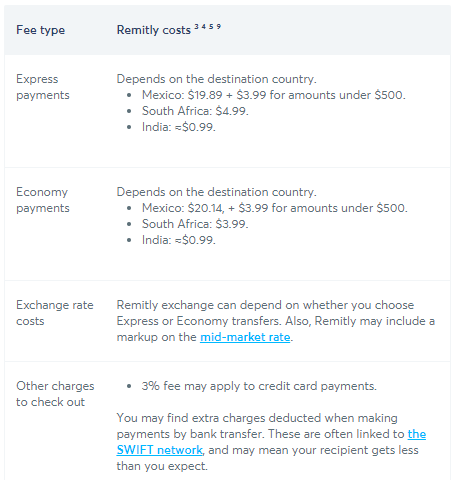

There are a few different fees you should look at when deciding if Remitly is the right currency service for you. Don’t forget to look at the upfront fees and the exchange rates, too, when you compare Remitly with other services, to make sure you get the best available deal for your payment.

It is important to know that Remitly differentiates between Express and Economy transfers: the main difference is the speed of the transfer, but there are differences in terms of the fees, too. In our examples, we’re considering three popular transfer routes from the United States: one to Mexico, South Africa and India, respectively.

Remitly transfer – Express payments

Express payments are funded by credit or debit card. Depending on the destination country, you’ll find different pricing structures.

Sending money to Mexico, for example, will cost $19.89, plus a $3.99 charge for amounts under $500³. If you want to send money to South Africa, you’ll pay on a $4.99 for each Express transfer.⁵ To do a Remitly money transfer to India (less than $1,000) with Express, you’ll be charged ₹73.22 (≈$0.99 at the time of writing).⁹

Funding payments with a credit card incurs an extra 3% charge.⁴

Remitly transfer – Economy payments

Economy payments are funded by bank transfer. Depending on the destination country, you’ll find different pricing structures.

Sending money to Mexico, for example, will cost $19.35, plus a $3.99 charge for amounts under $500³. Sending money to South Africa by the economy option will cost $3.99⁵, whereas for a Remitly money transfer to India (less than $1,000), you’ll need to pay ₹73.65 (≈$0.99 at the time of writing).⁹

One thing to watch out for when arranging an international payment, is extra charges added becauses of the SWIFT network. Bank transfers are often processed via the SWIFT network, in a process which involves several banks passing the money between themselves until it gets to the correct account. This is a long established way of making international payments – but it’s not usually quick, and it can be quite expensive, as all of the banks involved can deduct a fee as they handle the payment. Check with your transfer provider beforehand to see if you’re affected.

?You’ll be able to avoid the SWIFT network entirely for many payments if you choose to arrange your transfer with Wise. Wise uses a new approach to make cross border payments quicker and cheaper – and may help you dodge unexpected SWIFT charges, too.

What are the currencies that Remitly supports?

Remitly supports payments from 17 sending countries to 100 receiving countries across the globe. To check if your destination country is available, you’ll need to go to the Remitly website and model the payment. You’ll also be able to see the payment and delivery options, and exchange rates available to you.

Don’t forget to also compare the coverage and fees on offer at Remitly, with other providers. With a Wise multi-currency account, you can hold over 40 currencies in the same place, and also send money for low transparent fees to over 50 different countries online.

What is the exchange rate you get with Remitly?

To check the exchange rate on offer for the transfer you want to make with Remitly, you’ll need to model the payment online.⁶ It’s helpful to check the rate you’re given against the mid-market exchange rate, to see if a markup or margin has been added to it. This is a common practice, but can mean you pay more for your transfer than you need to.

The mid-market rate matters because it’s the one banks and foreign exchange services get themselves when they buy currency. However, it’s not necessarily the rate they pass on to their customers. Instead, you’ll find a margin is added to the rate, which the company then keep as profit in addition to the other fees you’ve already paid. This can make it hard to see the real cost of your cross border payment.At Wise, we never hide extra fees and charges in the exchange rate. We just use the exchange rate – independently provided by Reuters. That means fair, cheap money transfers, every time.

? Not all services add a markup to the exchange rate they use. Wise payments are processed using the mid-market rate. This can make it easier to see exactly what you’re paying for the transaction – and also save you money.

Are there any limits to the amount that you can transfer with Remitly?

When you create your Remitly account, you’ll see there’s a limit to how much money you can send at first. If you wish to, you can apply to increase this limit 24 hours after creating your account.⁷

To ask for an increase to your limits, you’ll need to log into your account, and click on the Sending Limits tab on the website, or the Increase Limits option if you’re using the app. You’ll then be able to see your options to increase your sending limits, which may require you to submit further details and documents to get approval.⁷

How long does an international transfer with Remitly take?

An Express transfer should be processed within minutes, with an Economy transfer taking 3-5 business days. You can track the progress of your transfer online by logging into your account.⁷

Is Remitly safe?

Remitly is a fully licensed organization and a registered Money Services Business with the US Department of Treasury. Money remittance companies strictly regulated by the Treasury, which means that sending money are probably safe with them.

How can you contact Remitly?

If you have a question about how you can use Remitly, you may find the answers you need in the FAQ section of their website. You can also track your payment online to check it’s making progress.

If you still need to talk to a member of the team, you’re advised to use the contact form on the Remitly website, to get help.

Their phone line is open 24 hours 7 days a week at (888) 736-4859

Finally, if you have a broader issue, the Remitly corporate contact address is:

Remitly, Inc.

1111 3rd Ave., Suite 2100

Seattle, WA 98101

Remitly Pros & Cons

Pros

- Mobile app experience – The Remitly iPhone app has a rating of 4.9 stars out of 5 on the App Store.

- Express payment options – for a fee, you can choose express payment options, which should be processed within minutes.

- Customer service – Remitly’s English phone line is open 24/7.

Cons

- Credit card fees: Remitly may charge you a fee of 3% if you choose to pay by credit card⁴.

- Mark-ups on the mid-market rate: Remitly may add a mark-up to the mid-market rate, meaning that you may pay more than you may expect.

Remitly reviews

According to Trustpilot, a consumer review website, Remitly gets a score of 4.3 out of 5 stars, with many of the reviews mentioning customer service and delivery times.¹⁰

Interestingly, Sitejabber, another consumer review site comes to a different conclusion, as on their page Remitly has a rating of 1.23 stars out of 5.¹¹

For this reason, we recommend that you shop around and check more Remitly reviews, such as this comparison with Xoom – it’s important that you make an informed decision before committing to any of the remittance providers.

Verdict: Is Remitly any good?

Remitly is a good remittance provider with different options for different use cases as users can choose between using Express or Economy payments. However, it is also need to be mentioned that Remitly may charge you a credit card fee of 3% if you choose this option⁴. Also, keep in mind that there may be mark-ups included with the mid-market rate, which practically means that you may pay more than your money transfer than you’ve previously expected.

For this reason, we always recommend that you shop around and see other options as well before you select which provider to use. However, with so many options out there, finding the best option for your particular transfer may require a little research. Check out the delivery options and fees available from Remitly, compared to some other popular specialist services like Wise, to get the best deal for you.